December 3, 2020 – Ways and Means Committee: Revenues Subcommittee

Robert Rehrmann, Policy Analyst, Department of Legislative Services

Evaluation of Regional Institution Strategic Enterprise Zone Tax Credit

RISE Zone Program Overview

- Established by Chapters 530 and 531 of 2014.

- Geographically targeted program that offers similar capital investment and employment tax incentives as the State enterprise zone program.

- Administered by the Department of Commerce, implemented by qualified institutions and local governments.

- Program objective is to promote economic and community development within a community anchored around a qualified institution.

- DLS evaluated the program during calendar year 2018.

Qualified Institution

- The Secretary of Commerce, with input from the Legislative Policy Committee (LPC), may approve an entity as a qualified institution if it meets program requirements.

- Institutions of higher education (public and private four-year institutions and community colleges), nonprofit organizations affiliated with federal agencies, and regional higher education centers qualify.

- Institution requirements include an intention to make a significant fiscal investment or commitment in the zone, a strong and demonstrated history of community involvement and economic development within the communities that the institution serves, and minimum financial qualifications established by the Secretary of Commerce.

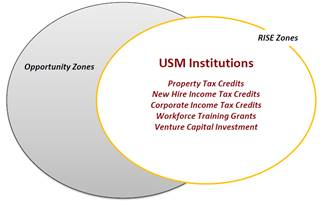

RISE Zone

- Geographic area that has a strong connection with a qualified institution and is targeted for increased economic and community development.

- Qualified institution must submit a joint application with a county, municipal corporation, or applicable economic development agency.

- The Secretary of Commerce, with review by LPC, approves zones.

- Zone designation is effective for five years and may be renewed for an additional five years.

- Must be in immediate proximity of a qualified institution, with exceptions for rural areas or instances in which an approximate nexus for increased economic and community development is established.

- Maximum of three RISE zones in a single county or municipal corporation.

Program Incentives

- Expanded tax increment financing (TIF) authority.

- Priority consideration for specified State financial assistance programs.

- Five-year property tax credit based the value of real property improvements.

- Credits can be earned for an additional five years if the zone is extended.

- Statute specifies base and enhanced credit percentages.

- Local governments may establish higher credit percentages.

- No state reimbursements for local property revenue loss.

- Employment Tax Credits:

- Identical to enterprise zone income tax credits.

- Regular employee: $1,000 (one-time).

- Economically disadvantaged employee: $6,000 (over three years).

- Enhanced credits if the business is within specified areas.

Evaluation Findings

- Program has a valid objective.

- No businesses have claimed tax credits.

- Program offers similar incentives to the enterprise zone, which was established in the 1980s to achieve a different objective and help communities with different characteristics.

- Program incentives are likely not the most effective policy option to achieve program objectives.

- Objectives across the zones vary, program incentives do not.

- Based on the history of the enterprise zone program, RISE zones may expand and become less focused over time.

Evaluation Recommendations

- Alter incentives to focus on promoting technological innovation and start up companies.

- Alter incentives to allow zone administrators to have more flexibility to achieve their specific goals.

- Clarify the interaction of the RISE and enterprise zone property tax credits.

- Limit the maximum size of zones.

Q&A

Delegate Darryl Barnes: You mentioned areas in which we can alter the RISE Zone. Can you elaborate on that?

Robert Rehrmann: Even though the objectives did vary across zones there were some common threads. We consistently heard in some of the zones there was a desire to either commercialize technology within these universities or encourage startup and technology companies or businesses that are associated with the universities or community colleges. Rather than emphasizing property taxes, which these businesses may not own property or they may not have a significant number of employees. One alternative that we heard was providing rent relief to these businesses.

Delegate Eric Luedtke: You suggested one alternative might be to consider some sort of rent relief, do you mean through the tax code or through grants?

Robert Rehrmann: That would be through grants.

Kelly M. Schulz, Secretary, Department of Commerce

I am a member of the University Systems Board of Regents. Maryland’s 2 and 4 year institutions are amazing assets that continue to leverage assets particularly regarding research and innovation and are crucial to our economic development efforts across the state. Our partnership with higher education is a critical part of economic development.

I am committed to ensuring the 19 business incentives in Commerce’s economic development toolbox to ensure effectiveness and accountability and where necessary to eliminate duplication and resolve issues of ineffectiveness.

From what I understand the Qualified Institutions and the local government partners for the

designated Zones put a lot of thought and effort into their applications. Each Zone has different strategic goals and we are not fully convinced a property tax credit incentivizing real estate development/improvements is the best tool needed to accomplish the goal of growing startup businesses. However, for those Qualified Institutions and RISE Zones such as Salisbury University and Morgan State University whose zones reflect a more traditional community development plan, an Enterprise Zone-like incentive such as a property tax credit and the TIF benefit make sense.

For the most part when discussing business expansion and attraction projects or opportunities for entrepreneurial development, the RISE Zone program compared with other incentives for job creation or capital investment does not generate demand or interest. I am well aware our university partners see the potential in this program. My staff has informed me of the numerous conversations with USM representatives over the last several years as well as a few legislative proposals introduced to better define and align the incentives under the RISE Zone program with the program objectives.

One recommendation has been to alter the statute to allow for the State to reimburse counties for any foregone property tax revenue as with the Enterprise Zone Program. That change would cause a fiscal impact that is not currently budgeted for and would only increase the cost of tax incentives.

There is varying degree of success or activity in the designated Zones. The most active and built out Zone is the College Park RISE Zone. Real estate activity occurred without a drawdown of the property tax credits allowed under law.

Response to DLS Findings and Recommendations

I. Existing Incentives Are Misaligned with the Program’s Objectives

Recommendation #1: The General Assembly should consider altering the current incentives to focus the objectives of the RISE Zone Tax Credit Program on promoting technological innovation. Given the importance of innovation, the RISE Zone Program incentives should be targeted to startup companies whose work is related to research activities conducted at the qualified institution.

This is a reasonable recommendation given the well-known challenges of the program/incentive as it currently exists. The Department of Commerce has no programmatic concerns with this recommendation. We do remain concerned about any proposals that lead to an increase in budget expenditures.

II. Objectives Vary Across Zones but Incentives Do Not

Recommendation #2: The General Assembly should consider altering the RISE zone incentives to allow zone administrators to have more flexibility to achieve their specific objectives. For example, one zone administrator could specifically target startup biotechnology companies while another could pursue a real estate developer.

Commerce has no concerns with this recommendation and we believe it to be sound. We do, however, believe Qualified Institutions and their government partners should detail in their applications criteria for measuring/evaluating impact of their Zone activities. The annual reports submitted to Commerce would then reflect the goals and criteria.

III. The RISE Zone Property Tax Credit’s Interaction with the Enterprise Zone Property Tax Credit Is Unclear

Recommendation #3: DLS recommends that Commerce clarify the property tax credit interaction of the RISE zone and the enterprise zone in regulation.

The interaction of the RISE zone property tax credit and the Enterprise Zone property tax credits is enumerated in Tax-Property 9-103.1(c)(4). This subsection provides:

1) If the qualified property is located in a RISE Zone and an Enterprise Zone, the property tax credit is 80% of eligible assessment for each of the five taxable years following the calendar year in which the property initially becomes a qualified property; and

2) If the qualified property is located in a RISE zone and a Focus Area, the property tax credit is 100% of the eligible assessment for each of the 5 taxable years following the calendar year in which the property initially becomes a qualified property.

While the authority to regulate this subsection belongs to the State Department of Assessment and Taxation (SDAT), Commerce recognized the statutory ambiguity in how the RISE and Enterprise Zone property tax credits would be calculated in an overlapped area and established guidelines which it has previously shared with SDAT counsel.

The ambiguity presented is this: the subsection stated the amount of the RISE property tax credits in an overlapped area, but not the amount of the Enterprise Zone property tax credits that would apply. If the RISE and Enterprise Zone property tax credits stacked or aggregated, the total credit would exceed 100% of the eligible assessment and the statute did not provide for a refund authority. In addition, as pointed out in the evaluation report, the RISE zone statute states that the amount of the property tax credit must be calculated without reduction for any other statewide mandatory property tax credits.

Consistent with the statutory language, Commerce developed the following guidelines which, if not consistent with legislative intent, should be clarified by the legislature in statute:

1) The cumulative property tax credit for a qualified property located in a RISE and Enterprise Zone is 80% of the eligible assessment. The State only reimburses local jurisdictions the amount which is reimbursable under the Enterprise Zone statute. The Enterprise Zone property tax credit is 80% of the eligible assessment in the first five years and therefore one-half of the cumulative credit of 80% would be reimbursable by the State. If the local jurisdiction awarded a greater amount for the RISE zone property credit, the excess over 80% would not be subject to one-half of the State’s reimbursement.

2) The cumulative property tax credit for a qualified property located in a RISE zone and Focus Area is 100% of the eligible assessment. The State only reimburses local jurisdiction the amount which is reimbursable under the Enterprise Zone statute. The Focus Area property tax credit is 80% of the eligible assessment in years 1-10, and therefore the State would reimburse one-half of 80% and the remaining 20% would not be reimbursable.

IV. RISE Zones May Become Less Focused Over Time

Recommendation #4: The General Assembly should consider limiting the maximum size of a RISE Zone. The largest RISE zone is approximately 500 acres.

Commerce agrees RISE Zones should be targeted. A large zone could lead to development that lies outside of its original rationale. That said, we have no idea how we could “scientifically” calculate a reasonable maximum size.

Conclusion

Overall the issues raised in the evaluation report are similar to observations Commerce has made as we have administered this program. No one can argue with the underlying premise of higher education institutions being positive drivers of economic growth in their communities. The challenge becomes identifying the best tool to make that happen.

As you consider potential changes to the RISE Zone program based on this evaluation and feedback from stakeholders, I encourage you to not look at this incentive program in isolation. It bears noting there a number of resources and programs designed to do some of the things RISE Zones were designed to do. Any changes should be considered in light of other place based incentives and initiatives designed to grow and attract innovation businesses.

Q&A

Delegate Jessica Feldmark: For clarification, on your response to the first recommendation. You mentioned you remain concerned about any proposal that leads to an increase in budget expenditures. Does that refer to how the value of the incentive is reflected in the budget or are you referring to increased administrative burden on your department?

Kelly Schulz: Not necessarily an administrative burden on our department because right now we’re not implementing a lot. We always worry about administrative burden with agencies when new programs are set up but I don’t consider that to be part of the issue. I think it’s more budgetary concerns, I heard a concept that there could be grants that could be distributed to businesses in order to be able to defer costs for them for rent or lease options.

James Hughes, Senior Vice President and Chief Enterprise and Economic Development Officer, University of Maryland

- This year we were awarded nearly $700 million in life sciences research.

- About $60 million of that was from private companies.

- We work with many of the biotech companies throughout the state doing sponsored research.

- We have been very busy this year working on COVID-19 vaccines and therapeutics.

- The Rise program we are very much focused on the idea of bringing businesses to the campus.

- In the last four months we have created 7 new startup companies so we have had a big focus on tech transfer.

- We have created an equity investment program that is investing in our companies.

- We have also strengthened our tech transfer activities.

- We have found the closer proximity they have to the university strengthens the collaborations and in the greater likelihood that they’re going to continue to do research with the university, and hire our graduates.

- It does come down to real estate and having available space, right now there is a shortage of lab space particularly in the greater Baltimore area.

- The RISE Zone ties in very nicely with our community objectives so we are very focused on economic development in west Baltimore.

- We are spending a lot of time trying to create jobs and working with the community.

- The city has approved expanding the RISE Zone to 5 building sites. We’ve had $400 million dollars of private capital investment in the bio park. Having 5 or 6 sites will increase our chances of having developed there.

- This spring we hope to break ground on a new $160 million dollar privately financed building that will enable us to expand the number of biotech, cyber security, and IT related companies that are located in the park.

- Compared to other jurisdictions that our developers are working in around the country, we have less incentives than many.

Ken Ulman, Chief Strategy Officer for Economic Development, University of Maryland College Park Foundation

- We believe with our greater College Park initiative we need to do the hard work that unleashes those companies out of labs.

- University of Maryland has done a really good job of prioritizing technology transfer, and new entity creation.

- The really hard work is getting them out of the lab, getting them established, and hiring.

- We’re onto something really important I think it just needs a few tweaks.

David Iannucci, President and Chief Executive Officer, Prince George’s County Economic Development Corporation

Prince George’s County was one of the first jurisdictions to approve a RISE Zone, in partnership with the City of College Park and Town of Riverdale Park. Our RISE Zone is proximate to the University of Maryland and the Discovery District. We did this with great enthusiasm, as building on the presence of the State’s flagship University is a fundamental part of the County’s economic development strategy, a strategy that has allowed Prince George’s County to become first in job growth in the State. In particular, we saw the RISE Zone as a critical tool to capturing and securing growth from the many startup technology companies that owe their presence to the University.

As an example of our enthusiasm for the program, in addition to the standard real property tax credit (50% for year one, and 10% for years two through five), Prince George’s County authorized a 75%/5 year property tax credit for businesses in key targeted high technology industries (including engineering, data analytics, earth sciences, virtual reality, cybersecurity, quantum computing, linguistics, additive manufacturing, ecommerce, robotics, aerospace, biotechnology and similar industries).

While the area around the University of Maryland is one of the most economically active areas in Prince George’s County, the RISE Zone incentives as statutorily created have not been of any assistance. We cannot say that the incentives have attracted any new businesses to the RISE Zone.

The challenge is the focus of RISE Zone tax benefits on property taxes. Startup technology companies with University connections in the College Park area that may be candidates for assistance are much more likely to lease space in existing buildings, rather than buy land, build new and take advantage of real property tax credits. We have discussed applying

RISE property tax benefits through landlords for the benefit of RISE eligible tenants with the plan that they would pass the saving along to their technology tenants, but have been turned down. Explaining a bifurcated property tax rate to both the landlord and prospective tenant is complicated, as some tenants may bring a qualified use, but others would not, making both application and marketing of the RISE property tax benefits challenging.

Businesses that are our RISE Zone targets are frequently cash poor, sometimes still not making a profit, and in no position to build or own real estate. We greatly appreciate this forum and the chance to review what was clearly a well-intended incentive program, and welcome the opportunity to discuss alternative methods for supporting job growth and commercial expansion from the type of companies that we all agree are important for Maryland’s future economic success. A focus on credits against business income taxes or profits perhaps should be explored.

Again, we appreciate the goals of the RISE Zone, and continue to believe that a refashioned program could achieve the goals that many share to support and grow technology companies coming out of the University of Maryland and other colleges and universities in the State. It is unfortunate that the initial iteration of the program has not succeeded, but Prince George’s County would be pleased to work with the Committee to revise the RISE Zone program so that it can meet those initial goals. An enhanced RISE program could be vital to help grow and retain valuable startups and innovation driven industry: we are ready to help fix the RISE Zone tax credit so that we can grow the Maryland economy.

Mitch Bonanno, Chief Real Estate Officer, Johns Hopkins University

- Johns Hopkins University is primarily focused on how incentive programs such as RISE Zone tax credits may help our neighboring communities and businesses evolve and grow.

- It is always hard to predict the future use of such programs for real estate development projects, many other local and larger market factors are much more influential in determining the pace of new projects.

- Having such programs known in advance as available is both a qualitative and possibly quantitative inducement for creative real estate development projects.

- Define incentive programs send a clear message of local and state support to the real estate market that may encourage consideration of projects, tenants relocating and otherwise regardless of eventual qualitative eventualities. Having known incentive programs in advance allows for earlier and more creative planning of how such programs may be utilized for projects, thus increasing the likelihood of use.

- RISE Zone specifically provides expanded use of tax increment financing.

Tom Sadowski, Vice Chancellor for Economic Development for the University System of Maryland

USM Profile

- 12 Institutions; 3 Regional Higher Education Centers

- Over 170,000 Enrolled students (130k undergrad; 40k grad)

- Affordable = 47% graduate with NO DEBT

- Diverse = 50% of undergrads identify as underrepresented or minority

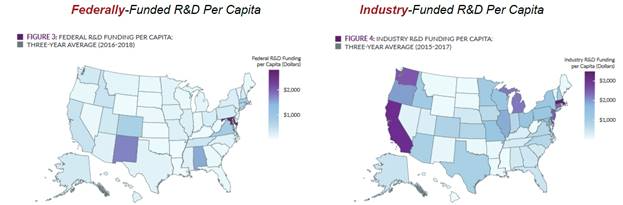

- $1.4 billion in sponsored R&D (> 90% government funded)

- $1.1 billion attributed to UMB/UMCP Mpower partnership…Ranked in top 10 nationally for external R&D funding

- 3 research Parks with 300+ tenants and 10,000 employees

- 10+ Incubator, innovation center or co-working hubs

- More than new 800 startups established since 2011

Rankings and Reports: Milken State Technology & Science Index

USM: Growing and Investing in Maryland’s Innovation Ecosystem

Q&A

Delegate Jheanelle Wilkins: I would like to better understand the issue related to the property tax credit and the property owners. How much of it is the complexity and the difficulty in developing and implementing the property tax credit? Versus something I heard regarding the property owner maybe not wanting to pass on that credit.

Ken Ulman: In my experience the unwillingness is not an unwillingness in a greedy sense. It’s that it would take so much paperwork and it’s unworkable; for that small benefit to then pass it on just doesn’t make sense. The only way this will really work as a property tax is if we lower a large user who is going to buy the piece of property and build their own major facility and while that can happen it’s rare. The purpose of this is to help smaller companies get to higher numbers of employees. In my experience of property tax credit is great for the developer when the developer is looking at all the numbers and whether it makes sense to build that building.

David Iannucci: It’s not a matter of greed. I’ve tried to explain to our finance department that we needed a building and there might be several thousand square feet, maybe it’s a quarter of a floor of a 5 story building. They were essentially going to have to create two different property tax rates for that. Essentially people said that was too much work and too complex. Frankly that complexity doesn’t translate in explaining the benefit to the tenant.

James Hughes: I think there are limitations to the real estate tax credit aspect but it is significant to our project in Baltimore. We have a situation where we’re trying to push the real estate developer over the edge to build $150-190 million dollar building. As they’re doing the calculations, saving effectively about a $1.25 per square foot on real estate tax for 5 years that Baltimore City would give up that revenue not the state. That helps put them over the edge as they do their rent calculations.

Tom Sadowski: It gets to a point where each zone has different goals and different strategic needs, which makes it that much more of a challenge

Delegate Eric Luedtke: Mr. Hughes can I ask a follow up to that? Do you think that it would be equally useful to attract that developer for them to know that their tenants might be eligible to apply for rental assistance through a state program?

James Hughes: Yeah I think that’s certainly helpful. The range of programs that Maryland has to help start ups is very helpful. What they like to be able to do particularly as they’re talking to Wall Street is say you know we have a locked in definite cost structure for a given building. So the idea of potentially getting grants is very helpful but when they are looking at the bottom line and looking at the return for the building, something that is definitive is critical.

Delegate Julie Palakovich Carr: What are the typical characteristics of a startup that you are seeking to keep near the university that is spinning off? In terms of size of employees, amount of revenue raised, operating revenues. Anything that could give us a better sense of what are the types of sizes and stages of companies that you are seeking to retain.

James Hughes: About 20% of our space is occupied by startups and those are companies generally coming out of the University. They are biotech firms that probably have raised $1-2 million and have 8-10 employees when they first move in. They go through a couple fund raising rounds and maybe 5 years later they’ve raised $60 or $70 million and they’ve grown to 20-30 employees. Generally the startups we have have raised about $1 million within that first year so they are perhaps more established. We have about 80% of the space now occupied by pretty established companies.

Ken Ulman: I agree. We’re one of three finalists for a major aerospace engineering company that’s an international company that’s down to three sites for its U.S. innovation center. We’re not sure if we’ll get it, but they want to be proximate to the university. Especially university with strengths in aerospace engineering, access to faculty, staff, and students. But it’s also part of the energy that having lots of companies around and lots of interesting dynamics. Also the amenity package of having restaurants and a hotel conference center and all those things. Our priority is to make sure we’re doing everything we can to help our own startups.

Kelly Schulz: The counties would come back and say the enterprise zone structure works really well. The RISE Zones are very similar to the enterprise zones but they are sometimes duplicative of the enterprise zones in the same geographical areas. The idea of placemaking and the idea of a very specific ecosystem building within these particular small technologies, I think it’s something that has been a strategy that the state has looked at for a long time period we just need to find the right model in order to be able to do that. At the department we look to see what is the right tool, in the conversation we’ve had on these types of tools so that you can’t take one product and accept that it’s going to be the best product for all of the individual entities that are coming to you. It is not a one size fits all.

Delegate Jessica Feldmark: On the issue of location and the sense of place making. Can anyone speak to the value added to the anchor institution and if you have ways of quantifying that?

James Hughes: We have teamed with 3 companies in particular in the biopark to win a $100 million worth of federal grants and that money is over about 8-10 years. Those are grants where in some cases we are the prime that’s applied for the grant but we have not had the resources in-house. We have teamed with a company that manufactures drugs, they have a GMP facility so we submitted and won a $30 million grant to NIH where the university and the company were able to split that money. We have been running clinical trials for the past 10 years that are NIH funded trials in partnership with a company in the biopark. We have become more entrepreneurial because we have entrepreneurs on the campus, we’re engaging enter faculty are looking at different ways of doing things.

Kelly Schulz: Building an ecosystem, it’s very selfish for Maryland. We want to have these smaller companies; we want to grow internally in the state of Maryland. But for us it’s one of our best recruitment tools that we have to attract outside companies. Being able to say listen we have this entire ecosystem that is all across the state and the state is committed. Our marketing scheme of the Maryland Future 20 is all because we needed to plant our flag in the ground to be able to say that Maryland is the home of these types of innovative companies. We had almost 200 applications that came in for the Maryland Future 20 that were nominated by other companies or by universities.

Ken Ulman: Quantifying is the tricky part. We can quantify increased tax base and we’ve done an analysis on the tax base enhancements for the state of Maryland. What is harder to quantify are some of the things just mentioned.

Mitch Bonanno: From the state standing standpoint, I think Maryland competes more so as a state than a number of localities. When you move to Virginia and some other areas I think there’s more fierce competition between the specific localities that have many of the same attributes. In Maryland there is this piece of competing as a state but as these individual areas develop I think it just raises the bar of the entire competitive landscape of the state.