December 8, 2020 – Maryland Health Insurance Coverage Protection Commission

Michele Eberle, Executive Director, Maryland Health Benefit Exchange (MHBE)

Johanna Fabian-Marks, Director of Policy and Plan Management, MHBE

State-Based Individual Market Subsidy Program Report

- SB 124/HB 196 (2020) requires MHBE to submit a report to the Senate Finance Committee and the House Health and Government Operations Committee on the potential design, implementation, and effects of establishing state-based individual market health insurance subsidies in Maryland, as well as an analysis of the appropriate allocation of available funding between subsidies and reinsurance.

- MHBE worked with Lewis & Ellis Actuarial Consultants (Lewis & Ellis), in consultation with the Maryland Insurance Administration (MIA), to model the design and impact of state subsidies on the populations targeted, the individual market overall, and the reinsurance program.

- Lewis & Ellis produced a report detailing their evaluation, which MHBE published for public comment from October 2 –November 2, 2020.

- To gather additional feedback on the proposed subsidy designs, MHBE formed a work group that met virtually, from October 7-November 12, 2020 on a weekly basis.

- On December 1, 2020, MHBE submitted the required report, which incorporates the Lewis & Ellis analysis, public comments, and work group report.

Maryland’s Uninsured Rate

- Maryland’s uninsured rate has been flat at about 6% since 2016.

- That’s better than the national average, but about double the rate in Massachusetts, which has the lowest

Reinsurance Program

Background: How does the federal 1332 waiver work?

- Reinsurance reduces premiums in the individual market by covering a portion of insurer’s claims.

- Lower premiums mean that the federal government’s costs to subsidize insurance for low- and middle-income people are also lower.

- The federal government passes those savings (“federal passthrough funding”) to MHBE to spend on the reinsurance program.

The Reinsurance Program Has Successfully Reduced Premiums

- Monthly premiums are down an average of 11.9% for 2021, and more than 30% compared to 2018.

- In 2021, Maryland’s lowest cost plans will be about 20-30% below US averages, depending on metal level.

But Not Everyone Feels the Benefit of the Reinsurance Program

- The benefits of the reinsurance program are primarily felt by households earning >300% FPL and particularly households earning >400% FPL (about $51,000 for an individual or $105,000 for a family of four), who earn too much to qualify for federal premium subsidies

- Because of the way the federal subsidy structure works, reductions in premiums resulting from the reinsurance program are not typically felt by individuals at lower FPLs.

- As a result, the reinsurance program is not an effective way to reduce premiums for individuals at lower FPLs, or to target subsidies towards specific populations such as young adults.

Comparison of 2021 Benchmark Plan Monthly Out-of-Pocket Premium Cost for 27-Year-Old in Baltimore City at 250% and 400.5% FPL, With and Without the Reinsurance Program

Reinsurance Program Funding Sources

- Two funding sources: federal pass-through and the state health insurance provider fee.

- The health insurance provider fee was 2.75% of health insurance premiums in 2019, dropping to 1% through 2023 (the term of the reinsurance program waiver).

- A federal fee of 2.75% of health insurance premiums was suspended for 2019 and repealed starting in 2021: combined impact of the state fee and the repealed federal fee is a net reduction in premium fees compared to when the federal fee was in place.

- Federal funding is expected to exceed program cost.

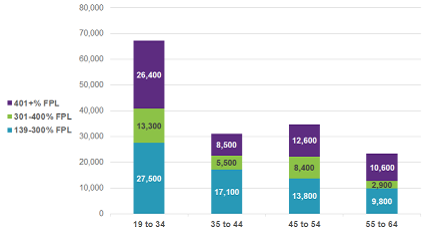

Uninsured Maryland Adults by Age and Federal Poverty Level

- About 156,000 of the uninsured are adults who are over-income for Medicaid and lawfully present.

- Of this group, young adults are most likely to be uninsured (67,200; 43% of total). A majority are below 400% FPL.

Potential Target Populations for an Individual Market State Subsidy

Individual Market State Subsidies: Designs and Modeling

Subsidy Background

Overall Modeling Results: Young Adult Subsidy Designs

Overall Modeling Results: 400-600% FPL

Reinsurance Program Impact & Funding Considerations

- Implementation of any of the modeled subsidy designs is not expected to negatively impact the reinsurance program.

- Maryland is not required to amend its current federal 1332 waiver or request an additional waiver in order to implement a state subsidy program.

- With federal approval (uncertain) unspent federal funds could be a funding source for a state subsidy program.

- State funds could be sufficient to both support reinsurance and fund a subsidy program.

Individual Subsidy Work Group Recommendations

- 10 of 11 members present ultimately voted to submit seven recommendations to MHBE to be considered if the legislature authorizes MHBE to implement an individual market subsidy.

Individual Subsidy Work Group Considerations

The Work Group identified a number of reasons for recommending young adults under 400% FPL as the initial target of a state subsidy program:

Conclusion

- A young adult subsidy at a range of total costs could meaningfully reduce the uninsured rate among young adults, further stabilize the risk pool, and reduce premiums for all enrollees.

- Implementing a state subsidy program is not projected to impact the reinsurance program.

- Annual funding under the health insurance provider fee is projected to be sufficient to fund a state subsidy program.

- If MHBE is authorized to implement a state subsidy program, it would be prudent to pursue amendment of the existing reinsurance waiver to enable MHBE to put surplus federal passthrough funding towards the subsidy program. However, federal approval of such an amendment is uncertain.

- Given the novel nature of a state subsidy program, the legislature may want to consider a pilot program to allow MHBE to gather enough credible data to refine longer-term projections of program costs.

COVID-19 Impact on Enrollment

COVID-19 Special Enrollment Period (SEP) & Impact on Total Enrollment

- Covid-19 SEP launched March 15 and is currently open through December 15.

- Total SEP enrollment through Dec. 6: 97,759

- 67% Medicaid

- 23% APTC

- 10% unassisted

- QHP enrollment is up 18% year-over-year as of Oct. 31

Q&A

Sanford Walters: Under the slide “Young Adult Subsidy Designs”, on the bottom of Column J, why is there a decrease from 34% to 30%? Is that due to the change in age?

Johanna Fabian-Marks: Yes, you hit the nail on the head there. The age expansion is the reason for the difference in percentage.

Sanford Walters: With the change in administration that’s coming in January, there is talk of change and people qualifying for subsidy based on family income. What would the effect of that be in this model and overall to enrollment in the exchange?

Johanna Fabian-Marks: That has been discussed. We would expect to see some potential increase in enrollment because there would be a larger group of people who are subsidy eligible. I haven’t seen any recent good estimates of those numbers, but the numbers I have seen are maybe less than 10% impact on enrollment.

Vincent DeMarco: Regarding a pilot. I’m concerned about doing a pilot when money is coming in from the assessment. I would urge not to start with the pilot. Why is there that pilot language and is it necessary?

Johanna Fabian-Marks: It’s certainly up to the state whether they wanted to institute a program or make it a time limited pilot that would be reconsidered after a period of time. I think either could be successful. The reason we included that suggestion of potentially considering a pilot is to provide the opportunity to gather more data before making a final decision on establishing a subsidy program.

Michele Eberle: The funding sources we have today are through 2023. For the federal reinsurance and state assessment, those are through 2023. A pilot would again give the opportunity to be able to determine longer term funding.

Delegate Bonnie Cullison: I am intrigued by the notion of a pilot. I just don’t know how you accomplish a pilot of this nature. Is it that we offer the subsidy to a certain amount of folks who meet our standards and then look at the impact?

Johanna Fabian-Marks: What we were thinking would be not in terms of specifying specific target population necessarily for a pilot. More so just setting potentially a time limit.

Senator Chris West: Regarding projected inflows and outflows. It appears the funding from the federal government as well as the state charge against the insurance company on premiums is producing considerably more money each year than is needed for the reinsurance, am I correct on that?

Johanna Fabian-Marks: That is correct. I do want to say that is a projection. We get the federal funding from the federal government annually.

Senator Chris West: What do you expect will be done with all those extra dollars that are being brought in but won’t be used to pay for the reinsurance in the next couple of years?

Johanna Fabian-Marks: The funding can roll forward to be spent on the reinsurance program. to the extent we wanted to use that funding to continue to the reinsurance program. If we continue the reinsurance waiver we could potentially roll the unspent federal funding forward to use in the future for the reinsurance program. We are also studying other options.